Fully insured vs self insured (and other funding questions HR pros need clear answers to)

Many U.S. companies are overpaying for health insurance due to suboptimal funding strategies, but there’s a spectrum of options beyond the traditional fully insured model, which could lead to significant savings. This blog demystifies the funding options, from gap funding to fully insured, to help HR professionals understand each approach.

Choosing the right health insurance funding model is one of the most impactful financial decisions an employer can make — not just in benefits budgeting but in workforce competitiveness, cost control, and long-term risk management. Employer health benefits routinely comprise up to 70% of total employee compensation costs, and funding strategy determines who ultimately pays for rising healthcare prices, how predictable costs will be year-to-year, and how much control an employer has over plan design and utilization.

For decades, most employers relied on fully insured health plans, where fixed monthly premiums are paid to an insurer in exchange for coverage and predictable budgeting. But in an era of compressed margins, escalating healthcare costs, and a greater emphasis on data-driven decision making, more organizations are exploring alternatives that offer greater transparency, flexibility, and control over spending.

Today’s employers are increasingly considering:

- Self-funded (self-insured) plans, which expose the employer to actual claims but provide access to real cost drivers and data

- Level-funded plans, which blend predictability with shared risk

- Gap funding structures, which help moderate risk while reducing premiums

This comprehensive guide breaks down the most common health plan funding options, explains how each model works, compares their trade-offs, and helps you determine which approach may be the right fit for your organization’s financial goals and benefits strategy.

What is a health insurance funding model?

A health insurance funding model defines who pays employee healthcare claims and how financial risk is managed. While employees often focus on provider networks and benefits, employers must decide how claims are funded behind the scenes.

It’s also important to distinguish funding models from related cost-management strategies. Approaches like reference-based pricing, captive arrangements, stop-loss structures, and alternative provider contracting aren’t funding models themselves. Instead, they’re tools that can be layered on top of certain funding models, particularly self-funded or level-funded plans, to help employers further control costs and manage risk.

The most common employer health plan funding options include:

- Fully insured health plans

- Self-funded (self-insured) health plans

- Level-funded health plans

- Gap funding arrangements

- Captive self-insured health plans

Each model balances cost predictability, risk, and control differently.

What is a fully insured health plan?

A fully insured health plan is the traditional model most employers are familiar with. In this arrangement, the employer pays a fixed monthly premium to an insurance carrier, and the carrier assumes full responsibility for paying employee healthcare claims.

How fully insured health plans work

- The employer pays a set premium per employee each month.

- The insurance carrier pays all eligible medical claims.

- The carrier absorbs the financial risk of high claims.

Pros of fully insured plans

- Predictable monthly costs

- Minimal administrative responsibility

- Lower financial risk for the employer

Cons of fully insured plans

- Higher premiums to account for insurer risk and profit

- Limited transparency into claims data

- Less flexibility in plan design

Who should consider a fully insured plan?

Fully insured plans are often a good fit for smaller employers or organizations that prioritize simplicity and budget predictability, especially when HR teams prefer to offload claims administration, compliance, and financial risk to an insurance carrier rather than managing those responsibilities internally.

What is a self-funded (self-insured) health plan?

A self-funded health plan, also known as a self-insured health plan, means the employer pays employee healthcare claims directly instead of paying fixed premiums to an insurance carrier.

Most self-funded plans include stop-loss insurance, which protects the employer from catastrophic or unexpectedly high claims.

How self-funded health plans work

- The employer sets aside funds to pay employee healthcare claims as they occur, rather than paying fixed premiums to an insurance carrier.

- Claims administration is handled either internally or through external partners, such as a third-party administrator (TPA), depending on the employer’s size, resources, and plan design.

- Stop-loss insurance is typically used to limit financial exposure by protecting against unusually high individual claims or total annual claims.

Pros of self-funded health plans

- Greater cost control and transparency

- Customizable plan design

- Potential savings if claims are lower than expected

Cons of self-funded health plans

- Less predictable monthly spending

- Increased financial risk without proper protections

- More administrative complexity

Working with a third-party administrator (TPA)

While not every self funded employer works with a third-party administrator (TPA), many choose to partner with one to manage the operational side of their health plan. A TPA is an independent organization that administers the plan on the employer’s behalf, without taking on insurance risk.

In a self-funded arrangement, a TPA may:

- Process medical and pharmacy claims

- Provide access to provider networks

- Manage eligibility, enrollment, and ID cards

- Support compliance, reporting, and plan documentation

- Deliver claims and utilization data to the employer

For many employers, working with a TPA makes self funding practical and scalable. It allows organizations to maintain financial control over healthcare spending while outsourcing complex administrative functions that would otherwise require significant internal resources.

Who should consider a self-funded plan?

Self-funded health plans are often a good fit for mid-sized to larger employers with stable cash flow that are comfortable taking on more financial risk and additional benefits administration in exchange for greater control. They tend to work well for organizations that want transparency into healthcare costs, the ability to customize plan design, and the flexibility to implement cost-management strategies over time.

Employers with internal HR or finance resources (or trusted external partners) are typically better positioned to manage the added operational responsibilities that come with self funding.

What is level-funded health insurance?

Level-funded health insurance is a hybrid funding model that combines predictable monthly costs with some elements of self funding. Employers make a fixed monthly payment, typically to a carrier or administrator, but that payment is not a traditional fully insured premium.

Instead, the monthly amount covers estimated claims funding, administrative fees, and stop-loss insurance. Claims are paid from funds set aside on the employer’s behalf, meaning the plan is technically self funded behind the scenes, and employers may share in savings if claims are lower than expected.

How level-funded health plans work

- Employers pay a predictable monthly rate.

- Monthly costs include claims funding, administrative fees, and stop-loss insurance.

- Employers may receive refunds if claims are lower than expected.

Pros of level-funded health plans

- Predictable monthly payments

- Potential cost savings compared to fully insured plans

- Access to limited claims data

Cons of level-funded health plans

- Less flexibility than traditional self-funded plans

- Refunds are not guaranteed

- May not be ideal for very small groups

Who should consider a level-funded plan?

Level-funded health insurance is often positioned as a stepping stone for employers transitioning away from fully insured coverage. It can be a good fit for organizations that want more cost control and visibility into claims without fully taking on the financial and administrative complexity of a traditional self-funded plan.

Level funded plans tend to work well for employers that value predictable monthly costs, are comfortable with some shared risk, and are interested in testing alternative funding models before committing to full self funding. They’re often appealing to mid-sized employers that are growing quickly or looking for potential savings while maintaining budget stability.

What is gap funding in health plans?

Gap funding is a hybrid funding arrangement designed to reduce premiums while limiting downside risk. It typically involves combining a fully insured plan with a reimbursement mechanism tied to claims performance.

How gap funding works

- The employer purchases an underlying fully insured health plan that typically has lower premiums but higher cost sharing, such as a higher deductible or out-of-pocket maximum.

- The employer then agrees to cover a specific portion of that cost sharing — the “gap” — for employees, but only if claims are actually incurred.

- Because the underlying plan is less generous, premiums are lower, and the employer takes on limited, defined risk tied to actual claims rather than paying for richer coverage upfront.

Example:

An employer offers a fully insured plan with a $3,000 deductible. Under a gap funding arrangement, the employee is responsible for the first $500 of the deductible, and the employer covers the remaining $2,500 gap if the employee incurs those costs. If the employee never reaches the full deductible, the employer benefits from lower premiums without paying the full gap amount.

In this way, gap funding allows employers to share risk with the insurer, reduce premium costs, and gain some of the financial advantages of self funding while keeping the core medical plan fully insured.

Pros of gap funding

- Lower premiums than traditional fully insured plans

- Reduced exposure compared to full self funding

- Useful for employers testing alternative funding models

Cons of gap funding

- Less transparency than self-funded plans

- Complex plan mechanics

- Limited availability depending on market

Who should consider gap funding?

Gap funding can be a good fit for employers that want to reduce fully insured premiums while taking on only a narrow, clearly defined amount of risk. It often appeals to organizations that are not ready for full self funding but are open to selectively assuming responsibility for certain claim costs.

This approach works well for employers that value cost savings and flexibility, want to improve benefits richness for employees without paying for it up front in premiums, and are comfortable administering a limited reimbursement arrangement. Gap funding is commonly used by employers who are experimenting with alternative funding models or looking for a low-commitment way to introduce shared risk into an otherwise fully insured plan.

What is a captive self-insured health plan?

A captive self-insured health plan is a form of self funding where multiple employers join together to share risk through a group-owned insurance entity known as a captive. Instead of each employer bearing claims risk entirely on their own, participating employers pool a portion of their risk while still retaining control over their individual health plans.

In a captive arrangement, employers typically self fund their expected claims and purchase stop-loss coverage through the captive for higher-cost or catastrophic claims. Any underwriting profits or surplus generated by the captive may be returned to participating employers over time.

Pros of captive self-insured plans

- Allows employers to share risk with a group rather than going it alone

- Potential to recapture underwriting profits instead of paying them to a commercial carrier

- Greater transparency into claims and cost drivers compared to fully insured plans

- Access to more favorable stop-loss pricing through pooled purchasing power

Cons of captive self-insured plans

- Requires a financial commitment and multi-year participation in many cases

- More complex than traditional self-funded or level-funded arrangements

- Savings are not guaranteed and depend on collective claims performance

- Less flexibility to exit quickly compared to fully insured plans

Who should consider a captive self-insured plan?

Captives are often a good fit for mid-sized to large employers that are exploring self funding or looking to take on risk in a more structured, collaborative way. By pooling risk with other employers, captives can help organizations ease into self funding while reducing volatility compared to going it alone.

They tend to work best for employers with relatively stable employee populations, an interest in greater cost transparency over time, and the financial flexibility to participate in a longer-term risk-sharing arrangement.

Employers considering captives typically have internal benefits or finance expertise, or trusted advisory partners, and are interested in participating in a more collaborative, long-term approach to managing healthcare risk rather than paying fully insured premiums year after year.

Understanding these differences is critical when evaluating health plan funding options.

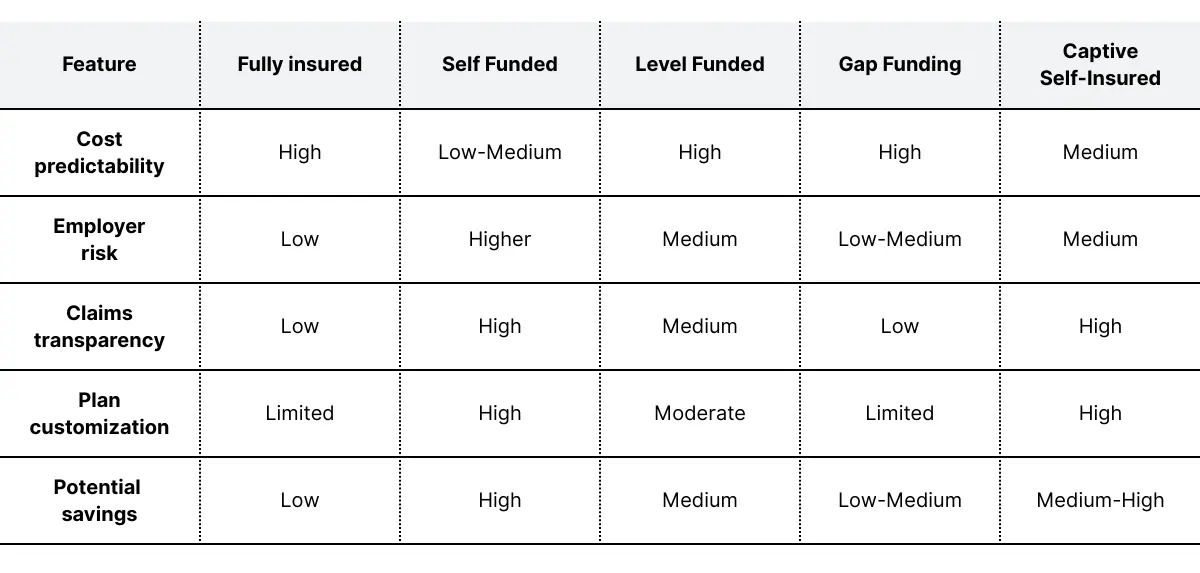

Funding models: key differences

Understanding these differences is critical when evaluating health plan funding options.

How to choose the right funding model for your business

When evaluating health insurance funding models, employers should consider:

1. Company size and cash flow

Larger organizations with stable cash flow are often better positioned for self-funded insurance, while smaller employers may prefer fully insured or level-funded options.

2. Risk tolerance

If your organization prefers predictability and minimal risk, fully insured plans may be the best fit. Employers comfortable managing some variability may benefit from self-funded or level-funded approaches.

3. Desire for flexibility and data

Self-funded plans provide the most transparency and customization, enabling employers to actively manage healthcare costs.

4. Long-term cost strategy

Alternative funding models can support broader cost-control strategies, including reference-based pricing, value-based care, and targeted plan design.

Frequently Asked Questions

Is self-funded insurance better than fully insured?

Self-funded insurance can be more cost-effective and flexible, but it carries more financial risk. The best option depends on company size, cash flow, and risk tolerance.

What is the difference between self-insured and self-funded?

There is no difference. Self-insured and self-funded health plans refer to the same funding model.

What is a level-funded health plan best for?

Level-funded health plans are often ideal for mid-sized employers seeking predictable costs with some opportunity for savings.

Key takeaways

- Fully insured plans offer simplicity and predictable costs but limited flexibility.

- Self-funded health plans provide control, transparency, and potential savings with higher risk.

- Level-funded and gap funding models offer hybrid alternatives for employers seeking balance.

- Choosing the right funding model depends on risk tolerance, company size, and long-term benefits strategy.

Working with an experienced benefits advisor can help ensure your funding approach aligns with both your financial goals and employee needs.

.webp)

.webp)

.webp)

.webp)